FamaGaia Socio-environmental FIF IS

The FamaGaia Socioenvironmental FIF IS Fund was created to democratize investment in the sociobioeconomy, balancing financial return and direct socioenvironmental impact. We make it accessible to mobilize capital to finance those who protect ecosystems through productive activities.

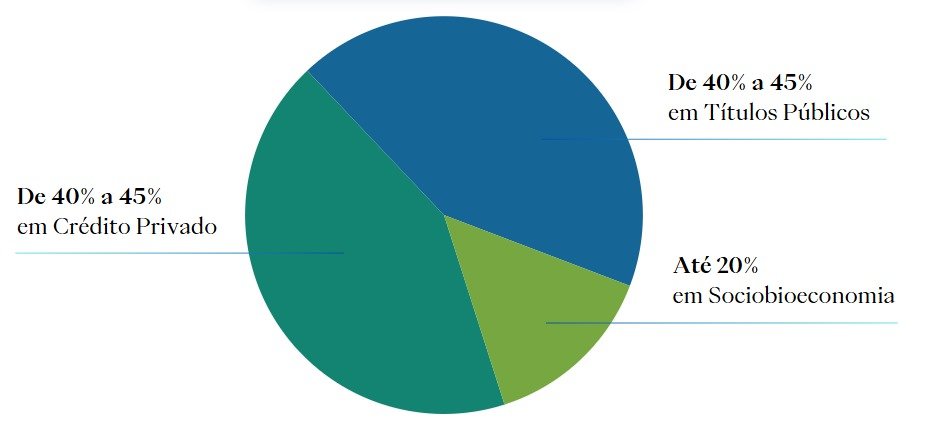

Allocation Strategy

The allocation strategy is guided by rigorous technical due diligence, in-depth qualitative analysis, and active monitoring of issuers.

With part of the resources allocated to government bonds and high-grade companies with socially and environmentally responsible practices, the portfolio offers diversification and balance to investors. This structure enables another portion of the capital to be directed toward the sociobioeconomy, through organizations that regenerate biomes, generate income, and promote productive inclusion.

Private Credit

Qualified selection of high-grade and socially and environmentally responsible companies.

Resources are directed to high-quality (high-grade) credit securities issued by financially sound companies with a proven track record of liquidity and impeccable reputation, whose operations demonstrate an unequivocal commitment to social and environmental responsibility. Priority will be given to companies that consistently and verifiably demonstrate management practices oriented toward the collective good, transparency, ethics, and a positive contribution to the territories in which they operate.

Government Bonds

Liquidity, risk mitigation, and cash management optimization.

Resources are directed to federal government bonds, such as LFTs (Treasury Financial Bills), with the purpose of composing the liquidity portion of the Class, optimizing cash management, and preserving capital during periods of higher market volatility.

Socio-bioeconomy

Addressing Inequalities and Regenerating Ecosystems

Resources are directed to high socioenvironmental impact projects and organizations, especially those with direct operations in vulnerable territories, provided they clearly demonstrate income generation at the local level, the promotion of biodiversity, and a commitment to zero deforestation.

In such cases, flexibility is allowed in the traditional high-quality credit criteria, recognizing that the transformative relevance of these projects may not be reflected in conventional financial metrics—but rather in their ability to address structural inequalities and regenerate ecosystems.

Investment Strategy

The FamaGaia Socioenvironmental IS Fund adopts a Sustainable Investment strategy, aiming to allocate resources intentionally and measurably into assets that seek to balance financial returns with positive environmental and/or social impacts.

The strategy includes private credit assets from companies that are recognized as leaders in social and environmental performance within their sectors. In addition, the investment guidelines are aligned with the United Nations (UN) Sustainable Development Goals (SDGs), within the context of the 2030 Agenda.

Indicators

Private Credit

The asset selection process combines financial rigor and socioenvironmental commitment:

• Companies whose operations demonstrate an unequivocal commitment to social and environmental responsibilit.

• Organizations with transparent management,oriented toward the collective good.

• Credit securities that are high-grade and highly liquid.

Socio-bioeconomy Portfolio

Environmental

Presence across all Brazilian biomes, fostering the sociobioeconomy.

Social

Income generation, credit access, and productive inclusion, according to project reports and engagement with local leaders.

Loan Rate

Offer credit at significantly fairer rates than the market average, promoting financial inclusion.

Insights

Key Facts

Fund dedicated to the general public.

| CNPJ | 58.564.711/0001-79 |

| Fund inception | 30/12/2024 |

| ANBIMA Classification | Private Credit Fixed Income |

| ANBIMA Code | F0001198394 |

| Manager | fama re.capital Ltda. |

| Administrator | GENIAL INVESTIMENTOS CORRETORA DE VALORES MOBILIÁRIOS S.A. |

| Management Fee | 0.7% per year |

| Performance Fee | No performance fee |

| NAV Calculation | Closing price |

| Fund transfer | Fund transfer via electronic bank transfer (TED) |

| Cut-off Time for Transactions | Until 2 p.m. |

| Subscription Price Date | D+0 business day |

| Redemption Price Date | D+13 calendar days |

| Redemption Payment | D+1 business day after pricing |

| Minimum Initial Investment | R$1,000 via digital platforms |

| Minimum Subsequent Investment | R$1,000 via digital platforms |

| Minimum Balance per Investor | R$1,000 via digital platforms |

| Taxation | Long Term |

| Risk Profile | Low |

Where is the fund available?

Invest directly*

*starting from R$1,000 with D+14 liquidity

How to invest?

1) If you already have an account with Genial Investimentos, ask your advisor or the support team to enable access to the FAMA GAIA Fund (CNPJ: 58.564.711/0001-79).

Headquarters

Rua Olimpíadas 134, conj. 42

Vila Olímpia, São Paulo-SP

04551-000

Contact us

contato@famarecapital.com

+55 11 5508 1188

The information on this website is for informational purposes only. It is essential to read the fund's prospectus and regulations before making any investment decisions. Past performance is not a guarantee of future results. The reported returns are not net of taxes. None of the funds are guaranteed by the fund administrator, the asset manager, or the Credit Guarantee Fund (FGC). To obtain the Prospectus, Performance History, and any additional information, please contact fama re.capital or the fund's administrator. For fund performance analysis, it is recommended to review a period of at least 12 months.